You are here

Glossary

The Office of Student Financial Aid Glossary contains several key words that appear frequently in our communications to the students and families of Indiana State University. If the brief descriptions are not enough, contact us for further assistance.

A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

A

-

Academic Year

This is the amount of the academic work you must complete each year, and the period in which you are expected to complete it. For Indiana State University the academic year is made up of a fall and spring semester (August - May). -

Alternative Loans

Loans offered by private lenders rather than the federal government. Interest rates and fees may vary based on your credit score.

For more information >> - Award Notification

The offer from Indiana State University that states the type and amount of financial aid provided if the student accepts admission and registers to take classes.

- Award Year

School year for which financial aid is used to fund a student's education. For Indiana State University award year is August - May.

B

- Balance

If your account charges exceed your financial aid funds you will owe the University. A bill from the University Bursars' Office will be emailed to the student with the balance due.

- Bill

The total amount you owe to the University. It is comprised of your tuition, fees and costs from University offices.

- Board

See food and housing.

- Books and Supplies

In a students' Cost of Attendance (COA) there is an estimation for the cost of textbooks and classroom supplies a student may have for a semester.

C

- Consolidation

The process of combining one or more loans into a single new loan.

- Cost of Attendance (COA)

The estimated total cost of going to Indiana State University for one academic year, it is not a bill. It includes everything - tuition and fees, food and housing, books and supplies, and other college-related expenses. Your financial aid award may cover a portion of the Cost of Attendance.

For more information >>

- Credit Hours

A credit hour is an amount of work represented in intended learning outcomes and verified by evidence of student achievement that is an institutionally-established equivalency that reasonably approximates not less than:- (1) One hour of classroom or direct faculty instruction and a minimum of 2 hours of out-of-class student work each week for approximately fifteen weeks for one semester or trimester of credit, or ten to twelve weeks for one quarter hour of credit, or the equivalent amount of work over a different period of time; or

- (2) At least an equivalent amount of work as required in paragraph (1) of this definition for other activities as established by an institution, including laboratory work, internships, practica, studio work, and other academic work leading toward the award of credit hours.

D

- Default

Failure to repay a loan according to the terms agreed to in the Master Promissory Note. For most federal student loans, you will default if you have not made a payment in more than 270 days. If you default on a federal student loan, you lose eligibility to receive federal student aid and you may experience serious legal consequences.

- Deferment

A temporary postponement of payment on a loan that is allowed under certain conditions and during which interest may not accrue.

- Dependency Status

Students can be considered “Dependent” or “Independent” based on several factors. Dependent students are required to provide parental data on the FAFSA. Independent students are not required to provide parental data on the FAFSA..

For more information >>

- Direct Cost

Expenses that are paid directly to Indiana State University. Also see Tuition and Fees, food and housing.

- Direct Subsidized Stafford Loan

See Federal Direct Subsidized Loans.

- Direct Unsubsidized Stafford Loan

See Federal Direct Unsubsidized Loans.

- Disbursement

This is the process in which the Office of Student Financial Aid coordinates with the Office of the Controllers to apply the student awards/loans to their accounts.

E

- EFC

See Expected Family Contribution.

- Endorser

Someone who does not have an adverse credit history and who agrees to repay a loan if the borrower does not repay it.

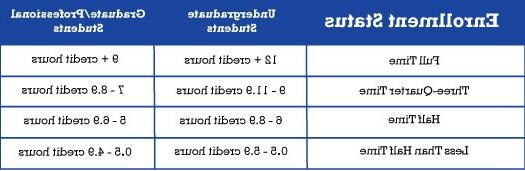

- Enrollment Status

A classification based on the number of credit hours you’re taking.Your enrollment status may determine your eligibility for some financial aid.

- Entrance Counseling

A required online educational session designed to ensure that a borrower understands the responsibilities and obligations of taking on a loan. To receive your loans, this must be completed at StudentAid.gov.

For more information >>

- Exit Counseling

A required online educational session designed to explain the responsibilities and obligations of repaying a loan. This is to be completed when the student graduates or drops below half-time enrollment status; complete at StudentAid.gov.

For more information > - Expected Family Contribution (EFC)

The ‘EFC’ is a number that determines students' eligibility for federal student aid. The EFC formulas uses the financial information students (and parents) provide in their Free Application for Federal Student Aid (FAFSA) to calculate the EFC.

For more information >>

F

- FAFSA

See Free Application for Federal Student Aid.

- Family Educational Rights and Privacy Act

Often refered to as ‘FERPA’ - The Act was passed by Congress in 1974 and is also referred to as the Buckley Amendment. Records that are protected by FERPA include: personal information, enrollment records, grades and class schedules. The University must have written permission from the student before releasing information from the student’s record, this is referred to as Proxy Access.

For more information >>

- Federal Direct Graduate / Professional Student PLUS Loan

A loan taken by graduate/professional students to help cover educational expenses. Eligibility is subject to credit history and other criteria, and the borrowers are required to repay the loan.

For more information >>

- Federal Direct Parent PLUS Loan

A loan taken by parents to help cover your educational expenses. Their eligibility is subject to credit history and other criteria, and the parents are required to repay the loan — not the student. If parents apply but don’t qualify for the Federal Direct Parent PLUS Loan, students could still apply for an additional Federal Direct Unsubsidized Loan.

For more information >>

- Federal Direct Subsidized Loan

A low-interest loan offered by the federal government to help cover your educational expenses. The Subsidized Loan is for students with financial need, and interest begins to accrue AFTER graduation or when the enrollment status drops below half-time.

For more information >>

- Federal Direct Unsubsidized Loan

A low-interest loans offered by the federal government to help cover your educational expenses. The Unsubsidized Loan is available to any student regardless of income, but interest begins accruing right after you receive the first loan disbursement during college.

For more information >>

- Federal Pell Grant

This Grant is awarded only to undergraduate students who have not earned a bachelor’s or a professional degree.Grants, unlike loans, do not have to be repaid.

For more information >>

- Federal Student Aid ID

Often referred to as "FSA ID" - Federal Student Aid Identification is a username and password combination that serves as a student's or parent's identifier to allow access to personal information in various U.S. Department of Education websites.

- FERPA

See Family Educational Rights and Privacy Act.

- Financial Aid Notification

A packet from the Office of Student Financial Aid regarding the types and amounts of estimated financial aid offered to you.

For more information >>

- Financial Need

The Cost of Attendance (COA) minus your Expected Family Contribution (EFC).

- Forbearance

A period of time when your monthly loan payments are temporarily stopped or reduced. Interest will continue to be charged on your loans. Be aware that unpaid interest may be capitalized (added to your loan principal balance) at the end of your forbearance period.

- Free Application for Federal Student Aid

The ‘FAFSA’ - A form provided by the U.S. Department of Education for applying for financial aid. It’s available at FAFSA.gov starting October 1. Remember to submit your FAFSA each year to receive financial aid for each academic year.

For more information >

- FSA ID

See Federal Student Aid Identification.

G

- Gift Aid

Financial aid that is awarded in the form of grants and scholarships. Gift aid may be based on merit or financial need. Gift aid doesn't have to be repaid.

- GPA

This stands for Grade Point Average.

- Grace Period

For certain types of federal student loans, a period of time afte you graduate, leave school, or drop below half-time enrollment when you are not required to make payments. You are responsible for paying the interest that accrues on unsubsidized loans during the grace period. If the interest is unpaid, it will be added to the principal balance of the loan (capitalized) whe nthe repayment period begins.

- Graduate/Professional Student PLUS Loans

See Federal Graduate/Professional Student PLUS Loan.

- Grants

A form of "gift aid" that does not need to be repaid. Grants are awarded based on financial need calculated from information in your FAFSA.

For more information >

.

H

- Homeless

An individual is considered homeless if he or she lacks fixed, regular and adequate housing. You may be homeless if you are living in a shelter, park, motel or car, or temporarily living with other people because you have nowhere else to go.

I

- Indirect Costs

Expenses that are NOT paid to Indiana State University. These include books and supplies for classes, transportation, loan fees, and personal expenses like recreational activities or items needed for daily living.

- Interest

A fee charged for borrowing money (taking out a loan). Interest is calculated as a percent of the loan's original amount (called the principal). Both the principal AND interest have to be repaid.

J

K

L

- Lender

The organization that made the loan initially; the lender could be the borrower's school; a bank, credit union, or other lending institution; or the U.S. Department of Education.

- Loan

Borrowed money from federal or private lenders that must be repaid with interest. Federal government loans include: Federal Direct Subsidized Loans, Federal Direct Unsubsidized Loans, Federal Direct Parent PLUS Loans, and Federal Direct Graduate PLUS Loans. Private lenders are through Alternative Loans.

For more information >

- Loan Disbursement

A loan will pay directly to the Office of the Controller and is reflected on the student's account in the MyISU portal. Most federal aid is disbursed 10 days before the start of classes. Each semester, half of your aid will automatically be applied to your bill, unless the loan specifies differently. Any exceess money may be refunded to you by check or direct deposit to your bank.

- Loan Entrance Counseling

See Entrance Counseling.

- Loan Origination Fees

Charges related to loan servicing.

M

- Master Promissory Note (MPN)

A legal document that describes the terms and conditions of financial aid loans. To receive loans from teh federal government, you're required to complete this legal agreement at StudentAid.gov.

For more information > - MyISU Student Portal Account

Your student account that allows you to check official email, register for classes, view academic records, pay your student bills, review your financial aid information, and much more.

For more information >

N

- New Student Orientation (NSO)

A required summer event for admitted students to meet an academic advisor, register for classes, speak with a financial aid counselor, and learn about Indiana State University resources.

O

- Outside Scholarships

A form of "gift aid" that does not need to be repaid. They're typically awarded by organizations other than Indiana State University. If you have received an Outside Scholarship be sure to notify the Indiana State University Office of Student Financial Aid by completing the Notification Form.

- Overaward

Excess financial aid (or an overaward) occurs when the student receives more financial aid than the calculated financial need or the estimated Cost of Attendance (COA).

For more information >

P

- Parent PLUS Loans

See Federal Direct Parent PLUS Loan.

- Payment Plans

Options for paying direct costs owed to Indiana State University.- A single payment plan means you pay for all charges for the semester (tuition and fees, food and housing) by the first day of classes.

- A monthly payment plan allows you to spread charges for the academic year across 10 months, which requires enrollment in Tuition Management Systems for a fee.

- A variable payment plan allows you to spread the amount and timing of payments in different ways, as determined by you, up to the final due date.

- Pell Grant

See Federal Pell Grant.

- Personal Expenses

In a students' Cost of Attendance (COA) there is an estimation for the personal expenses a student may have for a semester.

- PLUS Loans

A loan taken by graduate/professional students and parents of dependent undergraduate students to help cover your educational expenses. Their eligibility is subject to credit history and other criteria, and the borrowers are required to repay the loan.

- Principal

The original dollar value of a loan. For example, if you take out $5,000 in a loan, the principal is $5,000. When you repay the loan, you may pay more than just the principal - you may also pay interest that's calculated as a percentage of the principal. See Interest.

- Priority Processing Date

To guarantee your documents are processed before the start of the semester we recommend submitting your Financial Aid documents by the priority processing date. Documents received after this date will still be processed but risk not being ready by the start of the semester.- Fall Semester = July 1

- Spring Semester = November 15

- Summer Semester = April 15

- Proxy Access

This allows the student to authorize a proxy to view information on their academic record, protected by FERPA. Students can establish a passphrase allowing ISU representatives to share information that the student has authorized to be released specifically to the proxy.

For more information >

Q

R

- Refund

If the total amount of financial aid (loans, grants, scholarships, etc.) is greater than the total charges on a student's account, the student will be issued a refund. Refunds are mailed out to the student's permanent address or the student can set up direct deposit through the Office of the Controllers and receive the refund directly into a bank acount.

- Residency Status

The assessment of tuition and fees is based on students’ residence classification prior to the first day of classes for that semester or term. This initial classification will remain for subsequent academic semesters or terms unless and until such classification is changed. An individual could be considered a legal resident by the state, but not qualify as a resident for tuition purposes at Indiana State University. Residence for tuition purposes is based on an individual’s primary home, property ownership, or where taxes are paid.

- Food and Housing

The estimated cost of your on-campus residence and meal plan or the estimated cost of living off-campus. Learn about our residence halls at ngskmc-eis.net/reslife and our meal plans at indstate.sodexomyway.com

S

- Satisfactory Academic Progress (SAP) Policy

A financial aid policy that requires you to make progress toward earning your degree in order to keep your financial aid. Requirements include a minimum cumulative GPA, course completion rate, and maximum total credit hours attempted.

For more information >

- Scholarship

A form of “gift aid” that does not need to be repaid. They’re typically awarded based on merit, such as academic performance, artistic talent, athletic abilities, or other criteria.

- School Code

When completing your Free Application for Federal Student Aid (FAFSA) you will need to list our school code so the applications comes to Indiana State University. Our school code is – 001807.

- Self-Help Aid

Any source of money besides scholarships and grants, such as loans.

Financial Aid Notification (FAN) packet lists: Financial Aid sources other than scholarships and grants, such as Federal Direct Loans, Parent PLUS Loans, or Private Alternative Loans.Many forms of self-help aid must be repaid when you graduate or leave the university.

- State Aid

Financial Aid from a student's state of legal residence.

- Student Self Service Badge

Found on the MyISU Student Portal.This is a secure network environment for all Indiana State University community members.It is the gateway for students to access their official University information, including financial aid status, requirements, awards, and other account information.

For more information >

- Subsidized Loan

See Federal Direct Subsidized Loan

T

- Terms and Conditions

This is an acknowledgment of Federal Financial Aid regulations and acceptance of Financial Aid email communication to the students’ Sycamore email address.Acceptance of these terms and conditions opens the easiest method for accepting and processing of financial aid.

- Title IV

A term that refers to federal financial aid funds.Federal regulations state that any federal funds disbursed to a student’s account in excess of allowable charges must be delivered to the student (or parent in case of an Federal Direct Parent PLUS Loan).

- Transportation Cost

In a students’ Cost of Attendance there is an estimation for the transportation cost a student may have for a semester.

- Tuition and Fees

Costs associated with taking classes. Tuition is the price for instruction, which is based on both the number of classes you take and what state you’re from (see Residency Status). Fees for courses, programs, or labs are usually small extra charges for classes that require special supplies or equipment, such as brushes for paint class or beakers for chemistry lab. Financial aid does not directly cover fees, but excess funds (left over after your financial aid was applied to your eligible bill in your portal) may be refunded by check or direct deposit and can be used to pay for fees. Tuition and fees exclude housing, meals, textbooks, and other college expenses.Learn more about tuition and fees at ngskmc-eis.net/costs-aid

- Tuition Management Systems

An online service that allows you to manage tuition payments according to your selected payment plan.

U

- Unsubsidized Loan

See Federal Direct Unsubsidized Loan

V

- Verification

A process in which some students are selected to submit additional documentation to verify the information provided in their FAFSA. In some cases, financial aid may be subject to change after verification is complete.

For more information >

W

- Web Accept / Decline

If a student is eligible for Federal Direct Subsidized / Unsubsidized Loans they have the ability to accept or decline their loans electronically.

- Work-Study Program

Work-study is a federally funded program that allows you to work a part-time job to earn money for college. Work-study awards are based on financial need. These jobs can be found both on-campus and in the local community with help from the Indiana State University Career Center.

For more information >

X

Y

Z

Didn't find the term you were looking for? Visit the U.S. Department of Education Federal Student Aid site for their full glossary of terms.

Contact

220 North Seventh Street

150 Tirey Hall

Indiana State University

Contact Us

Office Hours

Monday - Friday

8:30 a.m. - noon and 1:00 p.m. - 4:30 p.m.

Monday - Friday

8:30 a.m. - noon and 1:00 p.m. - 4:00 p.m.